For some, owning multiple franchises is the dream.

For others, it’s an absolute nightmare. The reality is that it’s not quite that simple to figure out. There are many moving parts to itk and whether it ends up the dream or the nightmare comes down to several things.

First off, is franchising even right for you. When you speak with a franchising expert, that’s the first thing you should be asking yourself. It’s better to not get started in the first place if you don’t think it’s the right choice.

Secondly, you’ll need to find the right multiple-unit franchise opportunity. There are many, but there are also lots you’ll regret owning.

Maybe you’re seeing others do it successfully, and it’s giving you the desire to delve in yourself.

It’s a good thing to make sure you understand some of the things you’ll specifically need to be looking for if you’re trying to go from one to multiple franchises. That’s, of course, in addition to having a franchising expert in your corner who is able to spot some of the red flags you should be looking out for.

In this article, I’ll share important aspects to look out for when you’re hoping to own multiple franchises, but I’ll also touch on particular areas you focus on when you’re doing your due diligence on a company.

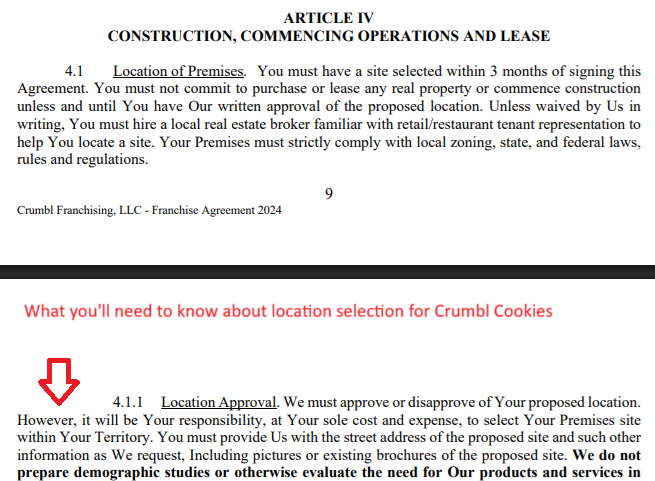

Then, when you understand the process a bit better, you can start looking for the right opportunity to pursue. It could be Crumbl Cookies, or it could be something entirely different.

Owning multiple franchises does not mean you only need to work with one company either, but instead you could spread your locations out across different companies. Some people prefer to open the same locations over and over as it teaches you the ins and outs of the business.

However, if you find out there are aspects to a business you don’t enjoy, you’re now stuck with multiple locations. Whereas, if you get locations spanning different franchises, you’ll spread your risk out across different business types. You can argue that it makes you less exposed if certain businesses are either cyclical or depend on macroeconomic factors.

Let’s look at the pros & cons

It can be a very lucrative way to create generational wealth. Just look at the screenshot of the billionaire who owns 2,400 units. However, there’s no way to get around the significant time and resources that will be deployed to get to the end goal. For that reason, it’s important to carefully consider both the pros & cons of multi-unit franchise ownership.

| 📜 Key Consideration | 🔍 Multi-Unit / FDD Insight |

|---|---|

| Territory carve-outs (FDD Item 12) | “Exclusive” often excludes non-traditional venues (airports, stadiums, campuses). If your growth strategy targets captive markets, negotiate either an absolute carve-out cap or a right of first refusal. |

| Cross-default clauses | A breach at one location can trigger default—and termination—of every franchise in your portfolio. Push for per-unit cure periods and language that isolates force-majeure construction delays. |

| Development schedule & liquidated damages | Area-development addenda typically require X units in Y years with per-unit liquidated damages ($25–$50 k) for misses. Tie deadlines to permit issuance or landlord delivery, not the calendar. |

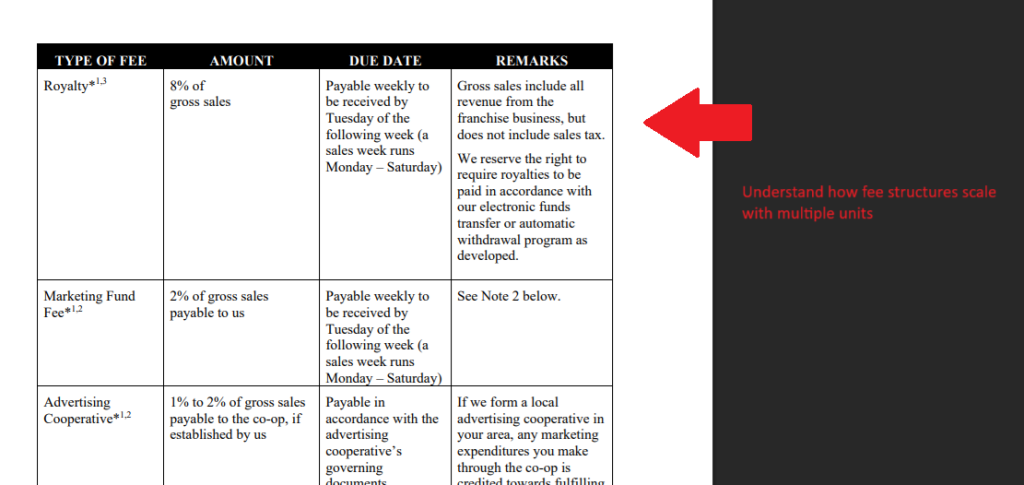

| Royalty / marketing scaling | Some franchisors drop royalties by 25–50 bp above five stores, but only if all units meet KPI thresholds—check the fine print before counting on margin lift. |

| Personal guarantees stack | Each new unit commonly re-opens your guaranty. Ask for a “burn-off” after two clean years per store or once leverage falls below a set EBITDA multiple. |

| Transfer & exit rights | Many FDDs prohibit selling a single under-performing unit until the entire development schedule is met. Secure the right to divest individual stores to recycle capital. |

| Hidden gotcha (consultant-level) | Early-termination clauses may require you to sign a general release before the franchisor decides on refunds of prepaid fees for unbuilt stores—insist those funds sit in escrow until a final post-closure audit clears. |

| 🚀 Enquire | Talk to Thomas about your multi-unit strategy ➜ |

Perfecting operations

When you’re operating multiple locations you’ll need to think bigger and be able to train the ground floor people on dealing with daily operations. High level operations relies on delegating so you have time to figure out higher-level objectives.

You rely on a team of managers to handle their own team of employees so resources can be used efficiently, and the business can run smoothly.

With multiple locations, you’ll be able to share resources across the locations. You can even share employees across locations if the locations are sufficiently close to each other. However, you’ll definitely not want to take advantage of this and have employees travel unnecessarily either.

Brand recognition

Each location you have becomes another reminder to customers that they should go and consume the products you’re selling. Even if you don’t want locations cannibalizing each other, there’s no denying that customers will buy more cookies when they’re repeatedly reminded of Crumbl Cookies going about their day.

You will better understand your target audience too from the increased data you’re getting from multiple locations. From that better understanding, you should ideally get a higher win-ratio on your various marketing initiatives.

More revenue potential

Profit is king, but to get to more profit from your franchises, you likely also need to get to more revenue. By having a larger footprint in the geographical location you’re in, customers will eb more likely to go to you.

Owning multiple franchise locations provides greater economies of scale, which in turn also helps with profitability. When you have a specific need at one location, but it doesn’t require a full time person, you can now spread that cost out over multiple locations.

Good franchising companies will help you throughout the journey, but owning more locations gives you better insights for sure.

However, with that said, let’s look at some of the downsides.

Being spread too thin

There’s such a thing as doing too many things, and owning multiple franchise locations is no different. More staff means more complexity, so you’ll need to be able to effectively put on your management hat.

If you’re not quite there in terms of your managerial skills, it’s very easy to get overwhelmed and being spread too thing.

Increased workload

At a certain stage, there is very little enjoyment left in increasing your workload. As you scale to multiple locations, it’s easy to increase your workload beyond what feels good.

You’ll need to find people you can rely on so that this workload does not end up consuming you.

More money you’ll need to invest

Investing more money is not a bad thing if you’re achieving your dream, but you need to make sure you are moving in that direction.

Budgets become even more crucial as you embark on this mission to financial success.

I’m proud of the work I do as a franchise consultant because I truly try and look out for your best interests. Some of my biggest success stories are in fact not the people that bought franchises and became successful, but rather those that ended up not buying.

While I love helping aspiring entrepreneurs the right business for them, it needs to be the right one.

| 🧠 Factor | 🔍 Why It’s Critical in Multi-Unit | 💡 Consultant-Grade Tip |

|---|---|---|

| Time-to-Break-Even Curve ⏳ | Some models open quickly but take 12–24 months to stabilize; cash flow from unit #1 might not support unit #2. | Choose a brand with 6-month breakeven or build-in phase gaps. Use bridge loans tied to AUV benchmarks—not fixed deadlines. |

| Staff Bench Depth 👥 | You can’t clone your GM. Multi-unit success depends on assistant managers ready to step up—fast. | Ask if the franchisor provides “GM-in-training” tracks. Recruit talent 60–90 days before site launch. |

| Real Estate Scalability 📍 | Great concept—but are there enough prime sites in your target DMA? Will you cannibalize yourself? | Use mapping software to simulate 3–5 store trade areas using population density and drive-time, not ZIPs. |

| Multi-Unit Royalty Incentives 💸 | Franchisors may offer stepped-down royalties, but only if you commit to multi-unit upfront. | Negotiate a ramp clause: commit to 3–5 units, but with opt-outs tied to revenue, not just time. |

| Territory Flexibility 📐 | You may grow out of your initial area or shift strategies—but are you locked in? | Ask for first right of refusal on adjacent territories and a defined transfer formula for selling your undeveloped units. |

Leave a Reply