Area development agreements in franchising – much like master franchise agreements – allow you to create a type of generational wealth you won’t see from simply owning a singular franchise location.

However, when you engage in choose to engage in area development, you’re looking at some different obstacles compared to when you’re just buying a singular unit.

When I consult aspirational franchise owners, I make sure they know the ins and outs so that you’re best set up for success.

It also means I go through various options to find the one that best suits the needs of the person I am working with.

After being asked about the topic a number of times, I’ve chosen to write this article on the topic. In comparison, make sure you read my article on master franchise opportunities as well.

Things to look out for, beyond and including the basics

For the ambitious entrepreneur, the area development agreement is a tool to allow expansion quicker than going one unit at a time. However, unlike master franchising agreements, you will not be allowed to sub-franchise parts of a territory, which is the biggest difference between the two.

Area development agreements are contractually binding, so it’s important you study the documents like a hawk. You don’t want to end up in a legal bind that could have been avoided.

Much like contracts concerning singular franchise locations, there is a lot of stuff about area development agreements (ADAs) that is standard. However, there’s also the less obvious rights and red flags to look out for. The same way that the franchisor is trying to cover their back, so are you.

The less-obvious pitfalls is often what will cause issues down the line, and what you’ll need to be particularly careful about during your due diligence.

As a seasoned franchise consultant, I advise aspiring area developers on the ins and outs of these agreements so your journey can be a success.. Here’s a breakdown of what you should be looking for, both obvious and subtle, when considering an ADA.

| 📜 Key FDD / ADA Item | 🔍 Area-Development Insight |

|---|---|

| Territory definition & carve-outs | Confirm exclusive vs. “exclusive except for non-traditional venues.” Airports and stadiums are often carved out—critical if your growth plan targets transit hubs. |

| Fee architecture | Watch for “umbrella” ADA fee + per-unit initial fees due on signing—ask to pay unit fees only when each franchise agreement is executed to smooth cash burn. |

| Cross-default clauses | A breach at one store can default the entire territory. Push for a cure period that applies per location and carves out force-majeure events (e.g., construction hold-ups). |

| Personal guarantees & succession | Guarantees often extend to all future units. Limit to the first term of each store and add a step-down when EBITDA coverage hits 1.5× debt service. |

| Transfer & exit rights | Some ADAs make the entire territory non-transferable until full build-out. Negotiate a right to assign developed units separately to recoup capital if you pivot. |

| Ongoing support & KPI reviews | Area developers often get fewer corporate field visits per store. Insert language guaranteeing quarterly KPI audits and pre-opening site vetting at no extra charge. |

| Hidden gotcha (consultant-level) | If the ADA terminates early, many FDDs require you to sign a general release before the franchisor decides whether to refund unearned fees—leverage escrow so funds are released only after a clean store audit. |

| 🚀 Enquire | Talk to Thomas about Area Development Strategy ➜ |

Development schedule

You’re looking at going down the path of becoming an area developer, but that also means there are certain expectations from the franchisor. It includes the development schedule included in the ADA which goes over the timeline and expectations for your expansion.

As such, you’ll need to follow the instructions outlined in the development schedule structure to avoid breaching the contract. The timeline you’re committing to should stay realistic, so you can both get access to the necessary capital and have construction go according to the plan.

Territory protection

ADAs explain the extent to which you have the exclusive rights to develop a certain franchise in a given territory. It also serves as your protection against other franchisees being allowed to develop anything there. However, make sure to check for exceptions to territory protection. They’re usually given for things like airports, universities, or other atypical venues.

Fees and finances

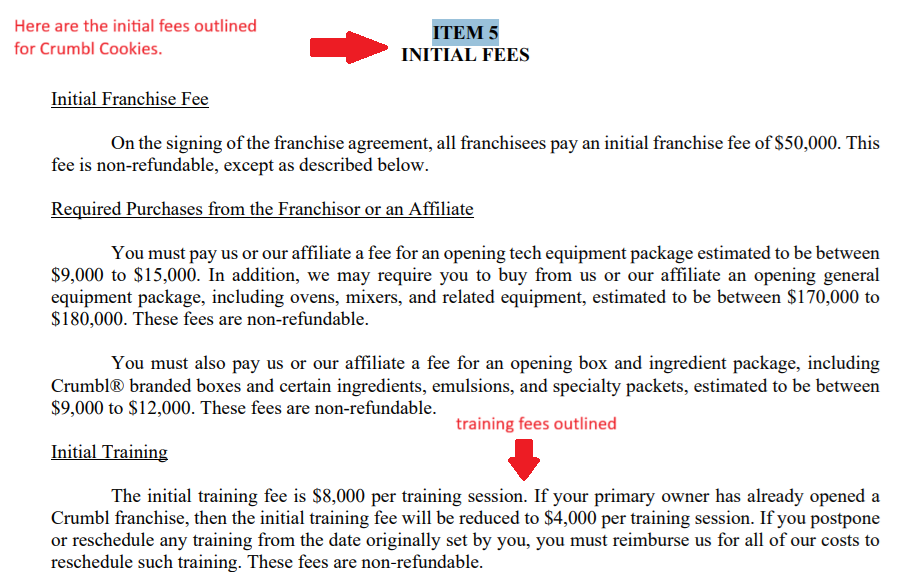

Area development agreements come with different fee structures than simply buying a franchise, so you’ll want to study all parts of the financial deal you’re embarking on. ADAs should clearly indicate all fees you’ll pay, so that you’re able to create your financial modeling. Typically, some fees are tied to benchmarks, which means you’ll want to know how fees scale as your locations do.

Training and support

One of the reasons you’re buying into a franchise in the first place is because of the training and support offered. The franchisor has set up systems, training, and other things franchisees could need, and you’ll want to tap into those resources. However, they sometimes have fees associated with them too, so make sure you understand when that’s the case.

Regardless, the scope of the training provided by the franchisor should be clearly outlined in the ADA.

Phased territory vesting

| ⚙️ Key Consideration | 🔍 Why It Matters | 💡 Consultant-Level Tip / Idea |

|---|---|---|

| Development Schedule “Grid” (e.g., 3 units / 36 mo.) |

Miss a build date → lose future territory or pay penalties. | Add a rolling 90-day cure tied to construction permits (delays are often landlord-driven, not franchisee-driven). |

| Performance Vesting vs. Calendar Vesting | Revenue or KPI triggers can replace hard dates—more flexible in volatile markets. | Propose “open + 12-month AUV” targets instead of fixed month counts for later phases. |

| Claw-Back / Territory Reversion | Brand can re-award undeveloped ZIPs to a competitor. | Negotiate a **right of first refusal** on any re-awards for 12 – 18 months. |

| Fee Structure (Master fee vs. pay-as-you-go) |

Large up-front territory fees burn cash before sites earn. | Convert 50 % of area fee into site-credit applied to each future franchise fee. |

| Capital-Reserve Covenant | Brand may ask for proof of funds for all units on day 1. | Offer staged escrow releases tied to each build-out to reduce idle cash lock-up. |

| Remodel Deadlines Sync | New builds could trigger remodels on your earliest stores sooner than expected. | Ask for a “remodel holiday” until last scheduled unit opens. |

| Cross-Default Clauses | Default at one store can jeopardize the whole ADA. | Limit cross-default to material breaches and grant a cure window + mediation. |

| Exit / Assignment Flexibility | If you can’t hit phase 3, an assignment clause preserves equity. | Negotiate pre-approved **zone resale VALUATION formula** (e.g., 4× trailing royalties). |

Enquire About Area Development Strategy

Vesting isn’t just a thing in franchising, but it’s also a thing in other business structures as well. It serves an important role in ADAs because it allows the franchisor to retain certain rights until you meet some obligations. Make sure the vesting is done according to a schedule you’re ok with, so that you know your rights are being protected.

Cure periods and defaults

I get it. Things don’t always go according to plan, and it’s not unlikely you get set back at times. Perhaps a permit is taking longer to get than you thought. Understand how going outside of the intended timeline will affect your rights, and make sure there are cure periods (grace periods) to give yourself some leniency. “Material breaches” should be clearly defined so you know when you’re at risk of losing the ADA rights you’ve worked so hard to secure in the first place. It’s also important so as to protect your investment in the project.

Renewal terms and exits

Renewal terms and exits are important considerations. You will want to know if you’re capable of selling your franchise locations and what the obligations are towards the franchisor if you do. While you may enjoy owning a certain type of business right now, it’s not sure it’ll remain that way.

Brand standards

I generally discourage franchisees from buying gym franchises because they tend to have obnoxious terms. From requiring new equipment every 1 to 5 years to absurd opening hours, these things add up. So can evolving brand standards. Essentially, it’s just a matter of making sure you compliance with set standards remains affordable.

Force majeure clauses

As with any business, franchises can incur force majeure events. Make sure you know what happens in case of a force majeure.

If you’re getting serious about seeking an area development deal with a company, make sure to book a call, so we can go over your options together.

Leave a Reply